- Latest report shows Filipinos driving usage of digital remittances, with many citing speed and convenience as top reasons for adoption of app-based remittance

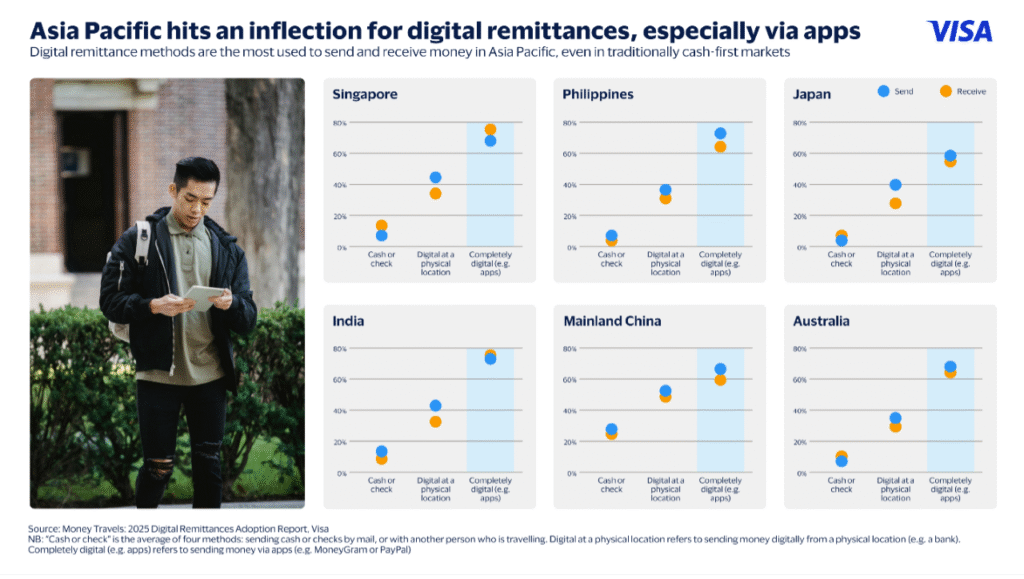

Philippines – Visa, a world leader in digital payments, has released its latest annual report on digital remittances, Money Travels: 2025 Digital Remittances Adoption Report, which was based on responses from 44,000 senders and receivers across 20 countries and territories, including the Philippines. The report presents findings on the latest remittance trends around the world, including Asia Pacific, a key region in the $905 billion global remittance landscape.

According to the report, the Philippines is one of the top adopters in Asia Pacific for digital remittances, with 74% sending money digitally and 66% opting for digital means when receiving funds. Majority of the respondents in the Philippines (73%) rely on digital payments as the fastest way to access funds, with about 45% of consumers also seeing it as a safe and private method for sending and receiving remittances.

“The Philippines accounts for more than 60% of total inbound remittance transactions in Asia Pacific, underscoring our robust position as a driver for regional remittance growth. The shift to digital remittances fosters greater financial inclusion, with more people and businesses able to access secure, regulated digital channels for managing and receiving money,” said Jeffrey Navarro, Country Manager for Visa Philippines.

While often cited as a top inbound remittance destination, the Philippines has grown its potential in the outbound money movement market, particularly for business-to-business (B2B) payments. In a previous iteration of the report, seventy percent of Filipino SMEs reported a need to procure goods and services from overseas, while 60 percent expressed interest in sending money overseas.

- Latest report shows Filipinos driving usage of digital remittances, with many citing speed and convenience as top reasons for adoption of app-based remittance

Philippines – Visa, a world leader in digital payments, has released its latest annual report on digital remittances, Money Travels: 2025 Digital Remittances Adoption Report, which was based on responses from 44,000 senders and receivers across 20 countries and territories, including the Philippines. The report presents findings on the latest remittance trends around the world, including Asia Pacific, a key region in the $905 billion global remittance landscape.

According to the report, the Philippines is one of the top adopters in Asia Pacific for digital remittances, with 74% sending money digitally and 66% opting for digital means when receiving funds. Majority of the respondents in the Philippines (73%) rely on digital payments as the fastest way to access funds, with about 45% of consumers also seeing it as a safe and private method for sending and receiving remittances.

“The Philippines accounts for more than 60% of total inbound remittance transactions in Asia Pacific, underscoring our robust position as a driver for regional remittance growth. The shift to digital remittances fosters greater financial inclusion, with more people and businesses able to access secure, regulated digital channels for managing and receiving money,” said Jeffrey Navarro, Country Manager for Visa Philippines.

While often cited as a top inbound remittance destination, the Philippines has grown its potential in the outbound money movement market, particularly for business-to-business (B2B) payments. In a previous iteration of the report, seventy percent of Filipino SMEs reported a need to procure goods and services from overseas, while 60 percent expressed interest in sending money overseas.

Digital apps too are embraced by older users, with 100% of respondents from the Philippines aged 65 and above planning to send remittances digitally. This is higher compared to the 45-64 age bracket (72%), 35-44 bracket (75%), and 18-34 bracket (74%).

With one billion people relying every year on remittance services and platforms, Visa continues to innovate and build solutions to enable payments businesses to enhance operational efficiency in money movement and broaden financial access for their customers.

Visa recently signed strategic money movement partnerships with key Philippine partners, such as USSC Money Services, Inc. (UMSI) and Rizal Commercial Banking Corporation (RCBC). These partnerships are focused on outbound remittances launched Visa Direct, a real-time push payment platform that facilitates delivery of funds directly to eligible Visa Direct for cards, accounts, and wallets worldwide.

“The shift in remittance trends reflect a broader change in consumer needs and preferences. Speed, security, and convenience are no longer optional — they are expected. Together with our partners, Visa drives this momentum, expanding financial inclusion through efficient, reliable, and affordable ways for Filipinos to send and receive money,” added Navarro.